India's Infrastructure needs an intervention (Part 1)

When flats in Gurgaon and Bengaluru sell for crores - the unaffordable prices, un-realistic rentals and unplanned cities are a threat to India's rising middle-class dreams.

(Pic courtesy : pixabay.com ; https://picryl.com/media/new-dehli-overpopulation-chaos-transportation-traffic-f0f0b7)

Rentals in India today are a ticking time-bomb.

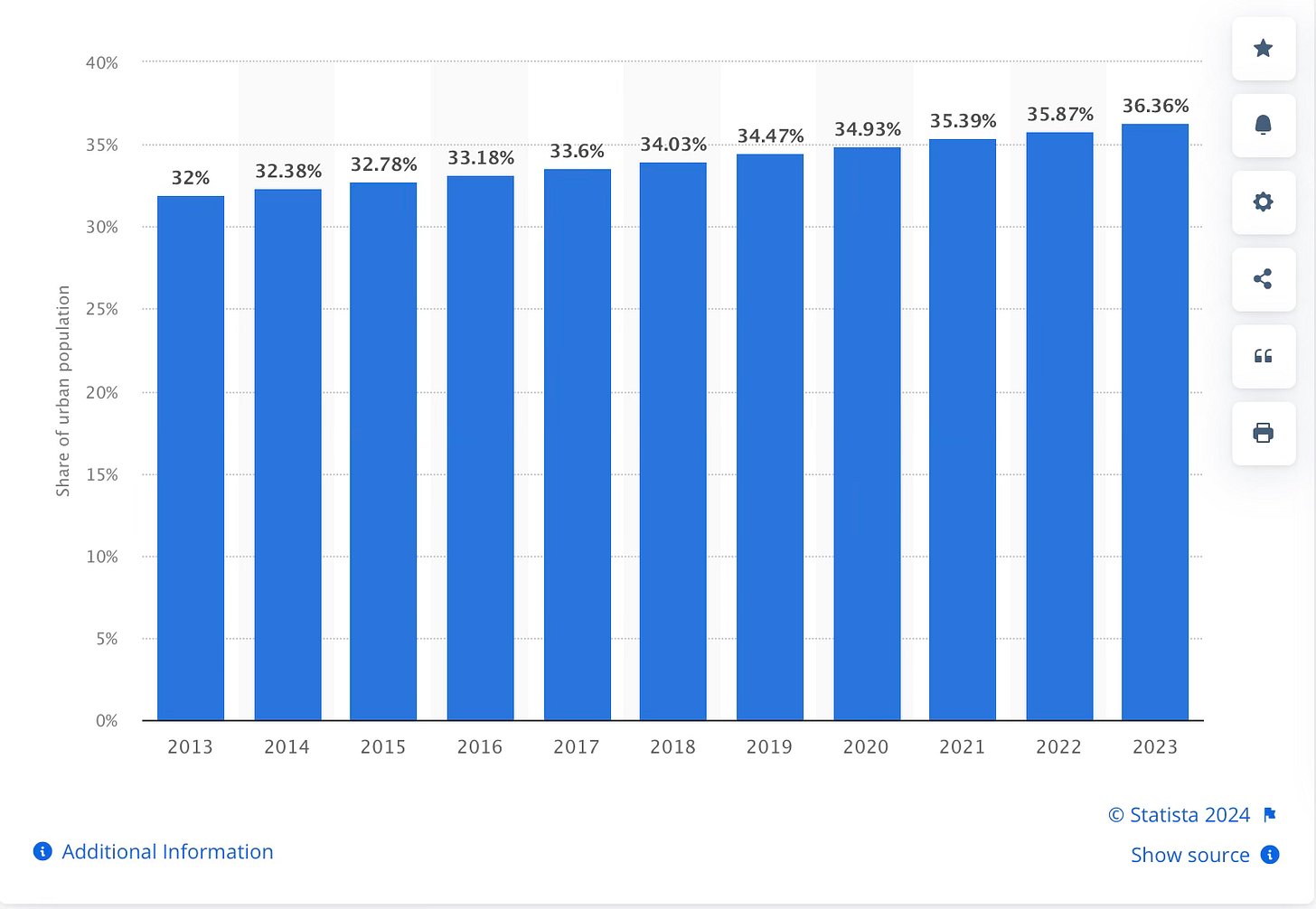

India is urbanizing rapidly. By 2036, its towns and cities will be home to 600 million people, or 40 percent of the population, up from 32 percent in 2013, with urban areas contributing almost 70 percent to GDP.

How well India manages this urban transformation will play a critical role in realising its ambition of becoming a developed country by 2047, the 100th year of independence.

Yet nearly 70 percent of the urban infrastructure needed by 2047 is yet to be built, sizeable investments will be required. But with the current real estate and rental rates, we might be left forever playing catchup with our dreams - and create mass urban and economic chaos in the process.

1. Why worry about this now

In major Indian cities, rents have outpaced income growth by alarming margins. A report by Knight Frank India revealed that rental yields in cities like Mumbai have risen significantly in the last decade, leaving middle-class families struggling to afford basic housing. This burden forces many to live in smaller spaces or relocate to suburban areas with inadequate infrastructure and long commutes.

The result? Urban inequality deepens as cities become playgrounds for the wealthy, while lower- and middle-income groups are pushed further to the fringes.

The disappearing around-the-corner businesses today

Primary Care Centers: A journey of decline

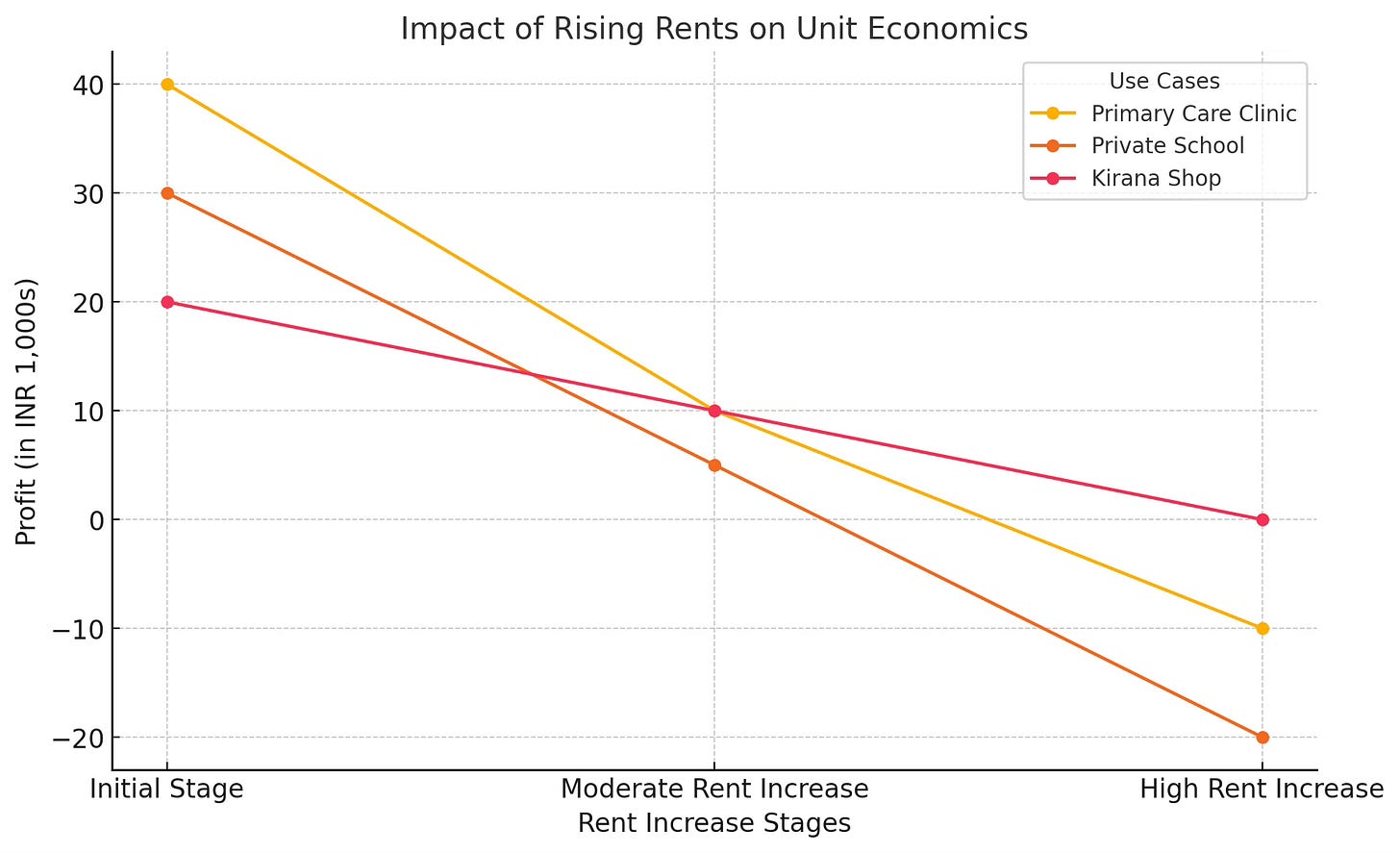

Take the case of a traditional clinic in Fazer town, part of the “old” Bangalore city limits. The clinic started with a rent of INR 40,000, generating a healthy monthly revenue of INR 1,50,000. With staff salaries of INR 50,000 and utilities at INR 20,000, the clinic achieves a modest profit of INR 40,000.

Rising Rents: Over five years, the rent increases to INR 70,000. With revenues largely stagnant, profit margins shrink to INR 10,000. Further hikes will leave no room for profitability, forcing the clinic to shut down or raise fees, compromising healthcare access.

Day schools & tuitions : private, smaller education spaces are facing mounting pressure

Mostly run after hours with couple of teachers from private schools who used tuition fee to supplement family income, a small centre would pays INR 2,00,000 in rent while generating INR 6,00,000 in monthly revenue. Teacher salaries and operational expenses total INR 3,70,000, leaving a net margin of INR 30,000.

Rising Rents: A 25% rent hike over three years pushes rent to INR 2,50,000. Margins turn negative, compelling the centre to increase tuition fees. This limits access to education for middle-income families, creating a vicious cycle of exclusion and financial instability.

Kirana Shop: from local staple to death-by-dark-stores

Initial Stage: The shop operates with a rent of INR 15,000, making INR 1,00,000 in monthly revenue. With inventory costs of INR 50,000 and other expenses totaling INR 15,000, it earns a profit of INR 20,000.

Rising Rents: Rent increases to INR 25,000, reducing the profit margin to INR 10,000. Another hike wipes out profitability entirely, leading to closure. This disrupts local supply chains, increasing dependence on larger, costlier retail chains.

Pharmacy: essential services under threat

Initial Stage: A pharmacy rents a storefront for INR 40,000 while earning INR 2,00,000 monthly. Expenses include INR 1,00,000 for inventory and INR 50,000 for salaries and utilities, leaving a profit of INR 10,000.

Rising Rents: A 20% rent hike increases costs to INR 48,000. With slim margins, any additional increase renders the business unsustainable. This results in reduced public access to essential medicines in urban areas.

The role of speculative real estate in driving up rental irrationality

Speculative real estate activity in India is one of the biggest deterrents to equitable progress. Investors buy and hold properties or land not to use them, but to profit from their appreciation. This practice inflates property prices and rental values far beyond what the local economy can sustain, creating artificial scarcity and driving up rents for residents and businesses alike.

Speculation distorts markets

Artificial Scarcity: Speculators hold onto properties, keeping them vacant, or are driven by the need for higher ROI; reducing supply in the market, and driving up rents.

Price Bubbles: Speculation inflates property prices, leading to unsustainable rental costs that do not align with wage growth or business revenues.

Impact on Essential Services: Essential services like schools, clinics, and small businesses are priced out of prime locations, as landlords prioritize high-margin speculative deals over long-term, stable tenants.

Urban Inefficiency: Large swathes of urban land remain underutilized or undeveloped, while businesses and families are pushed to less accessible areas, increasing commuting times and infrastructure strain.

Why regulating this spiralling speculative market is critical

Regulating this speculative real estate market is essential to ensure economic stability, equitable access to housing, and sustainable urban development. Speculative activity over the last decade is showing up in inflated property prices and rental rates, creating artificial scarcity that disproportionately affects middle- and low-income groups. Essential services like schools, clinics, and small businesses are already priced out of prime locations, disrupting communities and worsening economic inequality.

Unchecked speculation leading to inefficient use of urban spaces is already all around us - there’s more pubs than essential services, with vacant properties hoarded for profit while demand for affordable housing remains unmet. Implementing measures such as taxing vacant properties, capping speculative investments, and enforcing transparent ownership records can deter speculative practices. These regulations, coupled with rental controls, create a fairer market, stabilize rents, and ensure cities remain accessible and livable for all residents.

Curbing Vacant Properties: Policies to tax vacant properties at higher rates can disincentivize speculative hoarding of real estate.

Rental Controls: Implementing rent caps limits the impact of speculative price hikes on tenants and businesses.

Transparent Ownership: Mandatory disclosure of property ownership and transaction details can reduce opacity in the real estate market and deter speculative investments.

Public-Private Partnerships: Governments can work with developers to prioritize affordable housing and commercial spaces instead of speculative luxury projects.

Global Lessons

Hong Kong’s Vacancy Tax: To address housing shortages, Hong Kong introduced a tax on vacant new residential units to discourage developers from hoarding properties.

Canada’s Anti-Speculation Measures: Canadian cities have implemented taxes on foreign and speculative real estate investments to cool housing markets and stabilize rents.

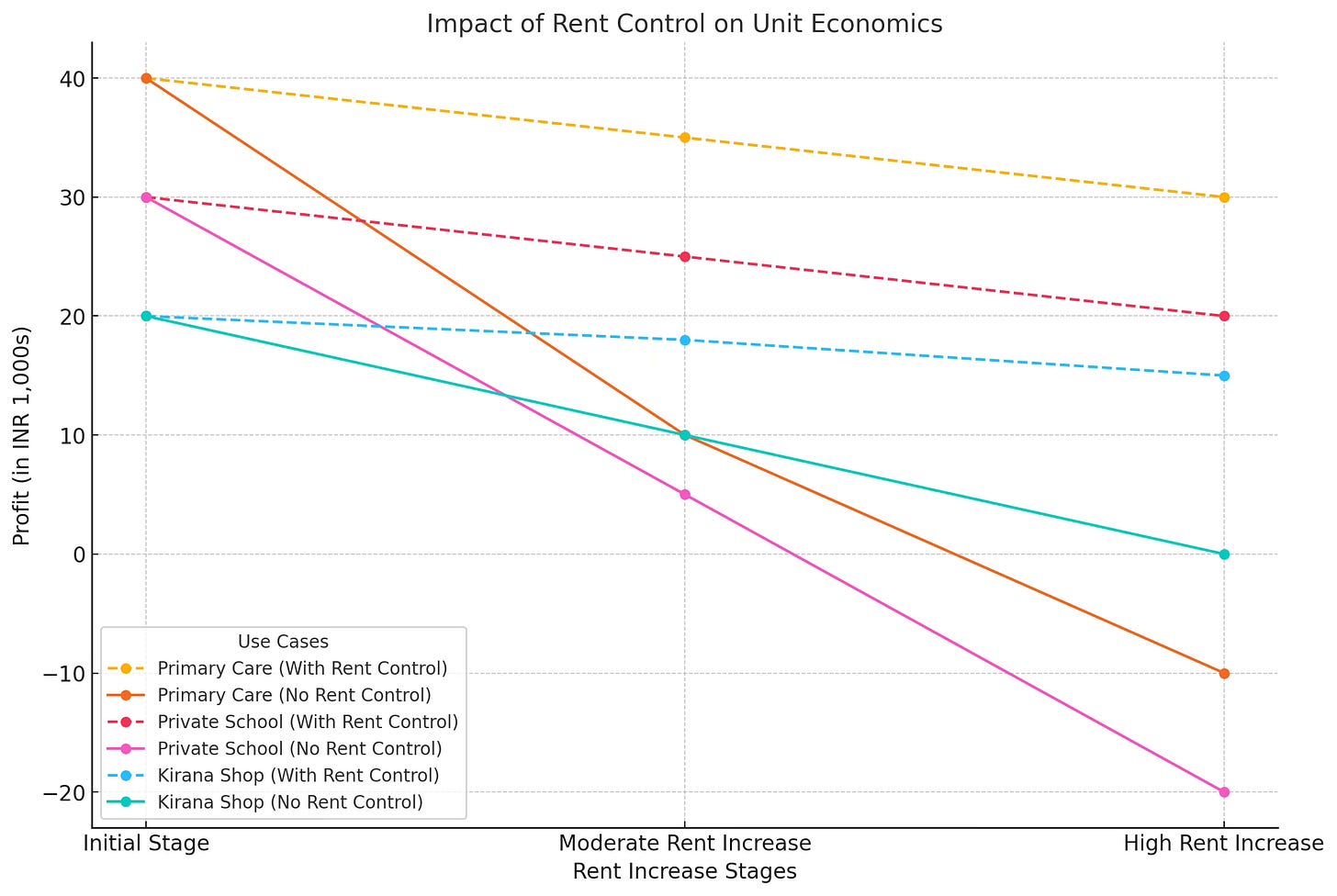

Why would rent control help?

Rent control boosts profits for businesses primarily by stabilizing one of their largest fixed costs—rent. Here’s a breakdown of how it impacts profitability and sustains businesses:

Stabilized rent costs

Without Rent Control: Adding the fact that India is a speculation driven market and not a investor driven market - Rents rise unpredictably, often outpacing inflation and revenue growth. This squeezes profit margins and forces businesses to either cut costs, raise prices, or close down.

With Rent Control: By capping rent increases, businesses can better forecast and manage costs over time, preserving profitability.

Improved financial planning

Predictability: Rent control allows businesses to anticipate future costs and allocate resources to areas like hiring, inventory, or service quality instead of firefighting rising rents.

Less Volatility: Stable rents reduce financial shocks that could derail a business's operations or expansion plans.

Encourages long-term investment

Without Rent Control: Rising rents discourage long-term investments in infrastructure, technology, or employee development, as the cost of staying in a location might make these investments unsustainable.

With Rent Control: Businesses are more likely to invest in growth and improvement when rent costs are predictable and capped, enabling better service and higher productivity.

Reduced pressure to raise prices

Without Rent Control: Businesses often pass on the burden of higher rents to consumers through increased prices, which can reduce demand.

With Rent Control: Stable rents allow businesses to maintain competitive pricing, fostering customer loyalty and sustaining revenue.

Enhanced profit margins

Rent control prevents disproportionate increases in operational costs, directly protecting profit margins. This is particularly important for businesses operating with thin margins, like small retailers or essential services.

The need of the hour: Rental controls and Zoning regulations

Implementing rental controls

Rental controls are policies designed to stabilize rents and protect tenants from excessive increases. Countries like Germany and cities like New York have successfully used these measures to make housing more affordable.

For India, this could include:

Capping Rent Hikes: Set limits on annual rent increases to prevent sudden spikes.

Standardizing Lease Agreements: Introduce clear guidelines to balance the rights of landlords and tenants.

Promoting Affordable Housing: Incentivize developers to build housing for middle- and low-income groups through tax breaks or subsidies.

Direct impact on inflation

Reduced Housing Costs:

Rent is a significant component of the Consumer Price Index (CPI) in most economies. By capping rent increases, rent controls directly limit the rate at which housing costs contribute to inflation.

In markets with steep rent hikes, rent controls can decelerate inflationary pressure.

Stabilized Consumer Spending:

When rents rise rapidly, households spend a larger portion of their income on housing, leaving less for other goods and services. Rent controls can stabilize housing costs, enabling consumers to maintain consistent spending in other sectors, which may help moderate overall inflation.

Indirect impact on inflation

Mitigation of Secondary Effects:

High rents can indirectly increase the cost of goods and services, especially in urban areas. For example, businesses facing higher rents often pass these costs onto consumers through price increases. Rent controls for commercial spaces may reduce these knock-on effects.

Labor Market Stability:

In areas with soaring rents, workers demand higher wages to afford housing, contributing to wage-driven inflation. Rent controls can help ease this pressure, making it easier for businesses to control labor costs.

Examples of rent controls and inflation

Berlin (2020): A five-year rent freeze initially reduced housing costs and stabilized inflation in the rental market. However, concerns arose about housing shortages due to reduced incentives for developers.

New York City: Long-standing rent control policies have helped stabilize rents for many tenants, but critics argue that they contribute to reduced housing supply and higher prices in the unregulated market.

Potential risks to inflation management

Reduced housing supply:

Critics argue that rent controls might discourage new housing construction or maintenance, leading to shortages over time. This scarcity could cause housing prices in uncontrolled markets to spike, adding to inflationary pressures. Considering that today’s affordability problem in most urban cities in India, we’re already at the other end of the spectrum - where people do not get housing due to exorbitant rental and housing prices.

To mitigate this, rent controls should be paired with policies that incentivize new housing development and ensure long-term supply.

Distorted market dynamics:

Rent controls could create disparities between controlled and uncontrolled segments of the housing market. For instance, while rents in controlled properties remain stable, uncontrolled properties might experience rapid price increases, distorting inflation metrics.

Testing the water for rental control in India - A phased approach

Conduct a baseline assessment in newly developing suburbs and townships outside existing cities

Objective: Understand regional rent dynamics, affordability thresholds, and market disparities.

Steps:

Map urban and semi-urban areas with severe rental inflation.

Identify tenant demographics, income levels, and housing supply-demand gaps.

Classify cities and districts based on rent pressure (e.g., high, moderate, low).

Pilot rent control policies in high-pressure areas

Objective: Test the effectiveness of rent control policies before larger implementation. States should set up controls and mandates for successful implementation.

Steps:

Select metro areas with skyrocketing rents (e.g., Mumbai, Bengaluru).

Implement rent caps tied to inflation or a fixed percentage (e.g., 5-7% annually).

Ensure properties below a certain size or rent threshold (e.g., affordable housing units) are prioritized.

Create a NRP - National Rental Policy Framework

Objective: Establish regulatory consistency across states while allowing local adaptation.

Components:

Standardized Rent Caps: Define limits for rent increases annually, tied to inflation or wage growth.

Long-Term Lease Incentives: Encourage leases of 3+ years with controlled rent increases for stability.

Exemptions: Exclude newly constructed properties for a limited period (e.g., 5-10 years) to incentivize housing supply.

Tenant-Landlord Dispute Resolution: Set up rent tribunals to handle grievances and ensure compliance.

Address key stakeholder concerns

Landlords:

Offer tax breaks or subsidies for maintaining affordable rents.

Provide low-interest loans for property maintenance to offset reduced rent revenues.

Tenants:

Protect against arbitrary evictions.

Introduce mandatory lease agreements with clear terms for rent increases.

Developers:

Incentivize construction of affordable rental housing through subsidies, fast-track approvals, or land grants.

Introduce taxation on speculative real estate

Objective: Discourage property hoarding and speculative practices.

Steps:

Tax vacant properties at higher rates to bring unused housing into the rental market.

Impose additional taxes on short-term property flipping to stabilise housing costs.

Establish digital infrastructure for transparency

Objective: Monitor rent control compliance and improve market efficiency.

Steps:

Develop a centralized rental database for lease registration and rent trends.

Enable tenants and landlords to report violations or access dispute resolution services online.

Expand rent controls to Tier-2 and Tier-3 cities

Objective: Prevent spillover effects from rent-controlled metros to smaller cities.

Steps:

Gradually extend policies to semi-urban areas experiencing rapid rent increases.

Customize rent control policies to match local economic conditions and housing markets.

Monitor and revise policies regularly

Objective: Ensure policies remain effective and adaptable.

Steps:

Conduct periodic reviews (every 3-5 years) to assess policy impact on housing supply and affordability.

Adjust rent caps, exemptions, or incentives based on market feedback and economic conditions.

Challenges to anticipate

Housing Supply Constraints: Balance rent control with policies that incentivize new construction.

Market Distortions: Address potential disparities between controlled and uncontrolled properties.

Implementation Costs: Allocate resources for monitoring compliance and resolving disputes.

This builds on the point-of-view from my tweet thread here. By phasing rent control implementation in this manner, India can tackle rising rents systematically, protect vulnerable populations, and encourage equitable urban development while avoiding the pitfalls of rushed or blanket policies. The next part will cover on the need for zoning regulations in India.

Interesting. Thank you.