The narrow corridors of high margin opportunity in India

Are rising land and logistics costs, paired with low per capita income, stifling business margins—and the country’s broader economic aspirations?

A Narrow Lane, A Wider Truth

In the crowded alleys of Mumbai’s Dharavi or the dense markets of North Chennai, small businesses operate under immense pressure. A garment workshop tucked into a single room, a kirana store balancing daily cash flow, or a small logistics firm managing deliveries on battered roads—they all represent India’s gritty entrepreneurial spirit. But these literal narrow corridors also reveal a deeper, systemic constraint: building profitable businesses in India is incredibly hard.

Why? Because costs have gone global, but consumer income remains deeply local.

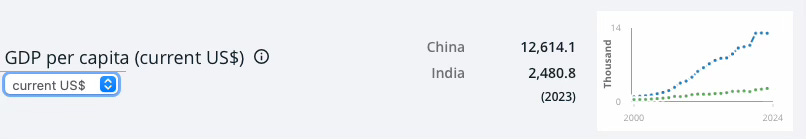

In a country where per capita income hovers around $2,500, business builders are forced to pay urban land costs comparable to Tokyo or San Francisco. Logistics costs remain among the highest in the world. The result is a recipe that stifles scalability, compresses margins, and depresses opportunity.

For eg., in India’s knitting belt in Tirrupur (near Coimbatore), over 35% of the small businesses have shut down in the last 3 years, unable to extract any margins between the high cost of input goods, and stagnant demand.

For every entrepreneur that sets up his shop or business; hundreds fold or stagnate, unable to break even in a market that demands affordability but imposes high structural input costs.

It’s not a lack of talent or drive that limits their growth—it’s the economic physics of trying to deliver world-class products and services to a price-sensitive consumer in an environment where fixed costs are unforgiving.

In India, hustle is abundant, but margin is elusive.

A Brief History of Margin Erosion

There was a time, in the early 2000s, when land was still relatively affordable and infrastructure projects like the Golden Quadrilateral promised better connectivity. The GST rollout and freight corridor projects were seen as catalysts for economic acceleration.

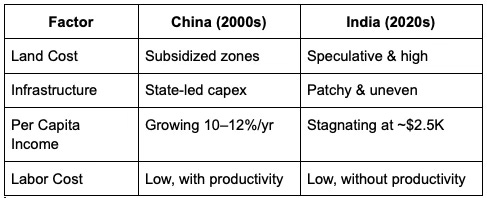

But while costs moved up, income growth didn’t keep pace. And unlike China in the 2000s, India didn't create a margin-rich middle class fast enough.

The central, state level and local attempts at structural reforms that spurred bits and pieces of growth were uneven, fragmented by geography, and often delayed by bureaucracy. For a population of a billion plus people clustered in cramped cities, Hyderabad and Bengaluru are the only global cities we have managed to build up in the last 30 years from scratch. Even in these cities, the infrastructure always seems to be playing catch up, the cities seems to be chocking itself due to pollution, traffic etc., but the real-estate bubbles continue to grow larger and larger. This means that while inputs became expensive, the average consumer will not see proportionate increases in purchasing power.

As India's urban centers transforms rapidly in terms of aspiration and architecture, this transformation often leaves behind the fundamental economics that make businesses sustainable - the amount of margins a business could make.

Blame it on short-sightedness, lack of support or system handicaps; what should have been a boon of demographic advantage in India is now turning into a pressure cooker of low-yield opportunities.

Today in India, the gap between input costs and monetizable demand has only continued to widen over time.

The Capital-Intensity Trap

India today suffers from a paradox:

Building businesses here requires global capital, but returns local rupees.

Land in Indian metros is among the most expensive in the world. Logistics consumes 14% of GDP—far higher than the 8–9% benchmark in developed markets. The average logistics cost per GDP among BRICS countries is at 11 percent. However, in the case of India, the cost share per GDP was 16 percent as of 2024.

Meanwhile, consumption remains shallow, driven by value-seeking behavior rather than premiumization. This means many industries are caught in a capital-intensity trap: they need to invest heavily to reach customers, but the return per customer is too small to justify the outlay. This crushes innovation and suppresses growth.

Even in asset-light industries like digital services, where one might expect cost efficiencies, the realities of CAC (Customer Acquisition Cost), regulatory compliance, and market fragmentation introduce unsustainable capital burdens.

For capital-heavy sectors such as manufacturing, logistics, retail, and energy infrastructure, the scale required to achieve breakeven is so massive that it crowds out new entrants. Therefore margins, which should be a reward for efficiency and insight, has become a luxury available only to incumbents or conglomerates with deep pockets.

When Margins Vanish: Real-World Case Studies

Let’s examine a few sectors where the squeeze is most visible:

1. Organized Retail:

Retail chains require large-format stores in high-footfall locations. But rents in top cities are exorbitant, while customer spends remain low. Even giants like Reliance Retail and D-Mart navigate this tightrope with difficulty, passing on the burden to their suppliers and squeezing out most margins.

Even with the rising trends of dark stores and on-demand delivery, the economics of per-square-foot profitability become shaky when each basket size remains under ₹500. Inventory turnover must be lightning-fast, and operational efficiency becomes a make-or-break metric. Meanwhile, smaller players and independent shops are completely priced out of urban retail landscapes.

2. Diagnostics & Healthcare:

To serve Tier 2 and 3 cities, diagnostic labs need hub-and-spoke logistics. But demand opportunities are too low to absorb the high cost of transport, quality control, and last-mile service. Latest D2C entrants who have tried to disrupt this industry, stand out as textbook case-studies of companies investing in CAC, yet not building the kind of margins or cashflows seen by traditional players.

Moreover, regulatory requirements, equipment depreciation, and skilled personnel add fixed costs that are hard to dilute. Health outcomes therefore suffer when these providers have no cushion for quality improvements or R&D.

3. EV Charging Infrastructure:

Setting up a charging station demands significant investment in land, power, and tech. Yet each charging session yields just ₹200–300. The math only works with enormous scale.

Until EV density grows significantly, operators are subsidizing usage, betting on long-term payoffs. For now, it’s a loss-leading game few can afford to play.

4. EdTech for India:

Acquiring customers digitally is expensive. But Indian families are unwilling to pay international-level subscription fees. CAC is dollar-priced, but ARPU (Average Revenue Per User) is rupee-based. This means long payback periods, high churn, and low pricing power. EdTech players either burn capital or pivot abroad—but rarely thrive in the domestic consumer market. Yet traditional offline players have built healthy business, with razor-sharp focus on every unit rupee spent per operating square foot. Unfortunately, the thin margins behind underlying unit economics mean we have more coaching centres, and less research institutes.

These are not isolated examples—they reflect a structural misalignment. The margin squeeze is not about poor structural management; it’s baked into the ecosystem.

The Crushed Opportunity Stack

When margins collapse, it’s not just businesses that suffer. A whole chain of opportunity is crushed:

Wages remain stagnant because businesses lack headroom to pay. In turn, consumer demand stays suppressed, completing a vicious cycle.

Income mobility is stalled as gig workers and MSMEs operate with zero leverage. Every rupee earned is reinvested into survival, not growth.

Equity creation becomes rare; few startups can scale to profitability or IPO. Early-stage capital dries up, and secondaries remain elusive.

Economic output slows as capital chases fewer viable investments. Instead of fostering a startup culture, we end up breeding survivorship anxiety.

In a country with abundant labor, youthful demographics, and entrepreneurial energy, the lack of margin becomes a binding constraint. It acts as a silent tax on our ambition.

The result is what might be called a "thin-air economy" — high activity, but low altitude. There is movement, but little uplift. Motion without margin is just plain friction.

R&D is a Cost Center Before It’s a Growth Driver, so no margins = no R&D.

Margins aren't just a signal of profitability—they're a prerequisite for innovation.

When a business has room to breathe financially, it can allocate resources toward research and development (R&D), which is essential for long-term differentiation and global competitiveness. Diving into the key aspects, margins are critical for R&D because:

R&D is a Long Game: Innovation takes time. It involves experimentation, failed attempts, and iteration. Without financial slack, businesses can't afford to take the risks necessary to innovate.

A lot of iterative research and development doesn’t yield instant returns. In most cases, it involves years of experimentation, failed prototypes, and iterations before something viable emerges. Companies with thin or no margins can’t afford to invest in long-gestation projects—they're too focused on short-term survival.

R&D Requires Talent and Infrastructure: Building a serious R&D pipeline means hiring scientists & top talent in each domain (countering brain drain with capital incentives and social incentives), investing in lab infrastructure, and filing IP. These are expensive and long-gestation costs that only margin-rich businesses can consistently support.

Without margin, you can't attract minds. Without minds, you can't build breakthroughs.

It Builds Competitive Moats: Margin enables reinvestment, and reinvestment drives product differentiation. This, in turn, builds a sustainable moat that shields businesses from price-based competition.

High-margin businesses can reinvest profits into improving their products and processes—creating IP that acts as a moat. Low-margin businesses are forced to compete on price, which is a race to the bottom.

Example: Apple, Nvidia, and Tesla succeed not because they’re the cheapest—but because they reinvest massive portions of their margin into product innovation.

It Fuels Future Growth: While efficiency helps survive today, R&D helps win tomorrow. Without margin, pretty much all companies get stuck in a cycle of survival, or keeping shareholders happy with whatever dividend yield that can be squeezed out. With margins, they can lead markets and shape categories.

Today in India, most firms focus on operational efficiency over innovation because their margins are too thin to do both. But R&D is what will allow a company to jump curves—to move from a commodity to a differentiated offering.

Without margin, you optimize for today. With margin, you invest in tomorrow.

Policy Incentives Aren’t Enough: Government grants or tax credits help, but they don’t replace the need for internal profitability. Sustainable R&D requires an internal capital surplus.

Simply put, margin is the oxygen R&D needs to thrive, and we’re running abysmally low on it.

The Narrow Corridors That Work

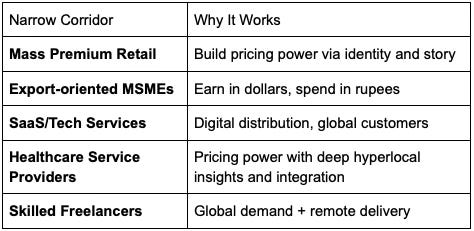

Still, there are niches where high-margin models do thrive. These businesses have one thing in common: they escape the land-logistics-income mismatch.

What makes these models viable is their insulation from the local constraint loop. Whether by tapping global markets, optimising for capital efficiency, or compressing logistics costs through tech, they sidestep the drag faced by other businesses.

For example, an Indian SaaS company serving U.S. clients can price in dollars while operating with Indian salary structures. A direct-to-consumer skincare brand like Sugar can command premium pricing by building a loyal brand following rather than renting expensive retail space. A diagnostic company can serve premium tests using custom pricing power to dictate costs and ensure volumes.

These corridors are narrow—they require precision, planning, and positioning. But they prove that margin is not impossible.

Widening the Corridor: Structural Recommendations

To unlock margin at scale, India needs a structural shift:

1. Land & Industrial Reform

Zoning, long-term leases, and end-use control can de-risk land acquisition and reduce speculation. State governments must coordinate with industry clusters to pre-approve land for specific use cases, allowing SMEs to rent, not buy. Industrial parks should emphasize ease of doing business over merely offering subsidies.

2. Freight & Rail Investment

Reduce logistics cost from 14% of GDP to 9% through multimodal transport, warehousing standardization, and digital tracking. A rail-led logistics spine could shift pressure off road networks and dramatically improve cost efficiency. Public-private partnerships must emphasize operational uptime and interoperability.

3. Digitally Native Infrastructure

Public platforms like ONDC, UPI, etc., can compress cost and expand reach. These platforms can enable real-time reconciliation, lower CACs, and democratize access to distribution channels. Their power lies in creating a digital public utility layer for commerce.

4. Skilling for Value, Not Volume

Create workforce pipelines that match global demand, not just domestic surplus. Focus on cognitive, design, and analytical skills, not just coding bootcamps. Leverage platforms like NSDC to partner with global recruiters and deliver placement-linked skilling programs.

5. Wage-Led Growth

Focus on increasing real wages via urban job creation, formalization, and SME support. Instead of relying on trickle-down, policy should aim for trickle-out: improving productivity in middle-tier firms, incentivizing hiring, and embedding labor into value-added services.

These changes are not cosmetic. They will redefine the geometry of opportunity in India.

Conclusion: Margin as Destination

India is not short of entrepreneurs or capital. What it lacks is margin. Margin is what lets you reinvest. It’s what allows businesses to pay better, grow faster, and dream bigger. Without margin, scale becomes a mirage.

For too long, Indian businesses have been told to make do. To work harder, stretch more, and hustle endlessly. But hustle without margin is just strain. The real unlock lies in creating structural pathways where good ideas can become sustainable, profitable enterprises without being crushed by fixed costs and frugal demand.

In a country as vast and diverse as India, business shouldn’t be a narrow corridor. It should be a wide highway.

But to build that, we must confront our cost structures, rethink our development model, and make room for margin—everywhere.